-

Prospect Credit REIT Achieves 13.35% Annualized Total Return Versus 6.28% Stanger-Tracked Non-Traded REIT Average Through Q3 2025

PCRED has outperformed the average return of Stanger tracked REITs through Q3 2025.

-

Record Commercial Real Estate Loan Modifications Expand Maturity Wall and Potential Credit Opportunities

In late 2024, a projected $957 billion of debt maturities were anticipated in 2025…

-

Prospect Credit REIT Announces a 9% Shareholder Distribution Rate per Annum on Net Asset Value for October 2025

Prospect Credit REIT, LLC, a non-traded real estate fund focused on real estate credit and managed by an affiliate of Prospect Capital Management L.P., announced today a 9% shareholder distribution rate per annum for October 2025 based on the most recent quarterly net asset value.

-

Prospect’s Real Estate Credit Strategy Now Available to Approximately 176,000 Financial Representatives and Advisors via Digital Alternatives Platforms iCapital, SUBSCRIBE, and SEI Access

Prospect Capital Management L.P., investment adviser to Prospect Capital Corporation, through its real estate private credit platform, announced today the availability of its private real estate credit strategy on the iCapital Marketplace, SUBSCRIBE Platform and SEI Access.

-

Prospect Credit REIT Provides $18.0 Million to Class A Stabilized Cash-Flowing Multifamily Property in New Rochelle, NY

Prospect Credit REIT, LLC, a non-traded real estate fund focused on real estate credit managed by an affiliate of Prospect Capital Management L.P., has closed on a credit investment to recapitalize Skyline Apartments, a 588-unit, Class A stabilized cash-flowing multifamily property in New Rochelle, NY.

-

Prospect Capital Management is Named a Top Private Credit Firm

Prospect Capital Management L.P. (“Prospect”), investment adviser to Prospect Capital Corporation (NASDAQ: PSEC) and other funds, announced today that GrowthCap has named Prospect a Top Private Credit Firm of 2025.“Thank you to GrowthCap for recognizing our longstanding approach and dedication,” said John Barry, CEO of Prospect. “We are proud of our long history of providing…

-

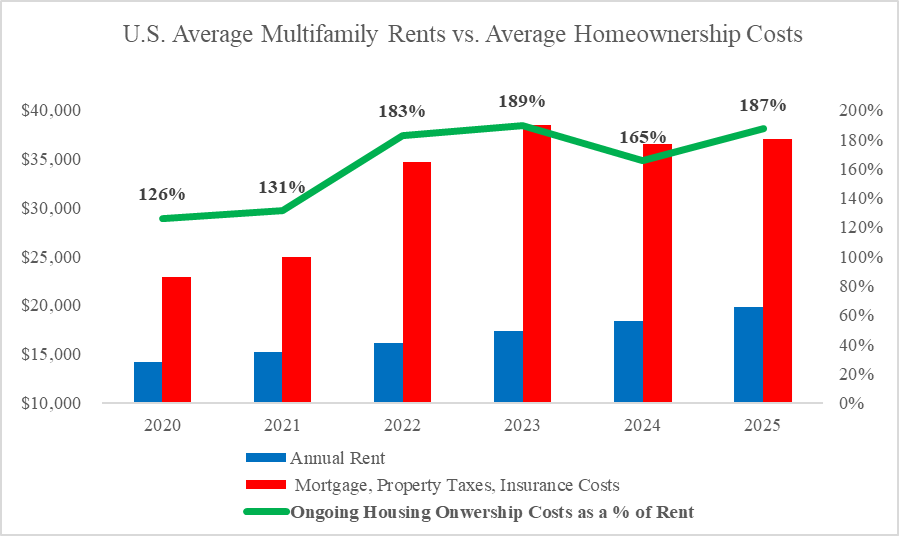

Homeownership Affordability Creates Multifamily Opportunity

PCRED explores homeownership affordability issues and the associated impact.

-

Seizing the refi opportunity in US multifamily credit

The following Q&A is taken from the October 2025 PERE Credit issue on the Evolution of CRE Credit. Seizing the refi opportunity in US multifamily credit Debt funds looking to take advantage of the surge in refinancing must be able to lend at attractive rates based on a highly efficient cost structure in an increasingly…

-

Prospect Credit REIT Achieves 14.2% Annualized Year-to-Date Total Return Versus 8.7% for Peers

For the six months ended June 30, 2025, Prospect Credit REIT, LLC, a non-traded real estate fund focused on real estate credit and managed by an affiliate of Prospect Capital Management L.P., has achieved an annualized total return of 14.16% to investors. Inception-to-date, PCRED has achieved an annualized total return of 13.01% to investors.

-

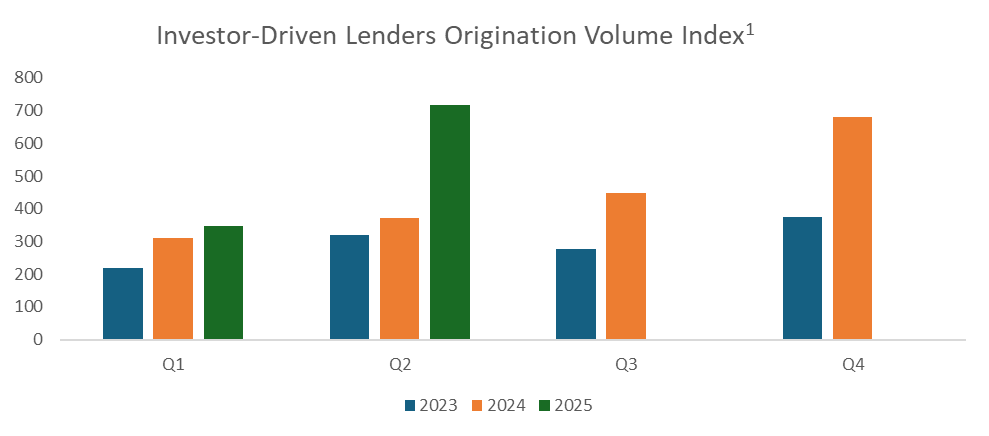

Non-Traditional Lenders Growing Market Share

Rising interest rates and balance sheet restrictions have contributed to a decline in traditional lender (bank, insurance company, and government-sponsored enterprise) loan volume as a percentage of new originations. Investor-driven lenders such as debt funds, mortgage real estate investment trusts (mREITs), and other alternative lenders are increasing their share of mortgage originations.